Emir Reporting Template

Emir Reporting Template - Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Trs centrally collect and maintain the records of all. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Guidelines for reporting under emir. Reports must be filed using a. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Emir mandates reporting of all derivatives to trade repositories (trs).

This form will make you a derivatives star reporter PostTrade 360°

Reports must be filed using a. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Trs centrally collect and maintain the records of all. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. In such context, this document aims at.

EMIR STRATEGY OTC LITE SOLUTION INTRODUCTION AND OVERVIEW

Guidelines for reporting under emir. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Reports must be filed using a. Emir mandates reporting of all derivatives to trade repositories (trs). Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in.

ISDA/FOA EMIR Reporting Delegation Agreement

Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir mandates reporting of all derivatives to trade repositories (trs). Reports must be filed using a. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating.

EMIR Trade Reporting

Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Trs centrally collect and maintain the records of all. Finally, the validation rules document contains also a template for notifications.

EMIR reporting explained what you need to know

The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Guidelines for reporting under emir. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Reports must be filed using a. With the implementation of the second emir refit, reporting to a trade repository has.

EMIR Trade Reporting

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Reports must be filed using a. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Trs centrally collect and maintain the records of all. The european securities and markets.

PPT CME European Trade Repository PowerPoint Presentation, free

Reports must be filed using a. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Finally, the validation rules document contains also a template for notifications of reporting errors.

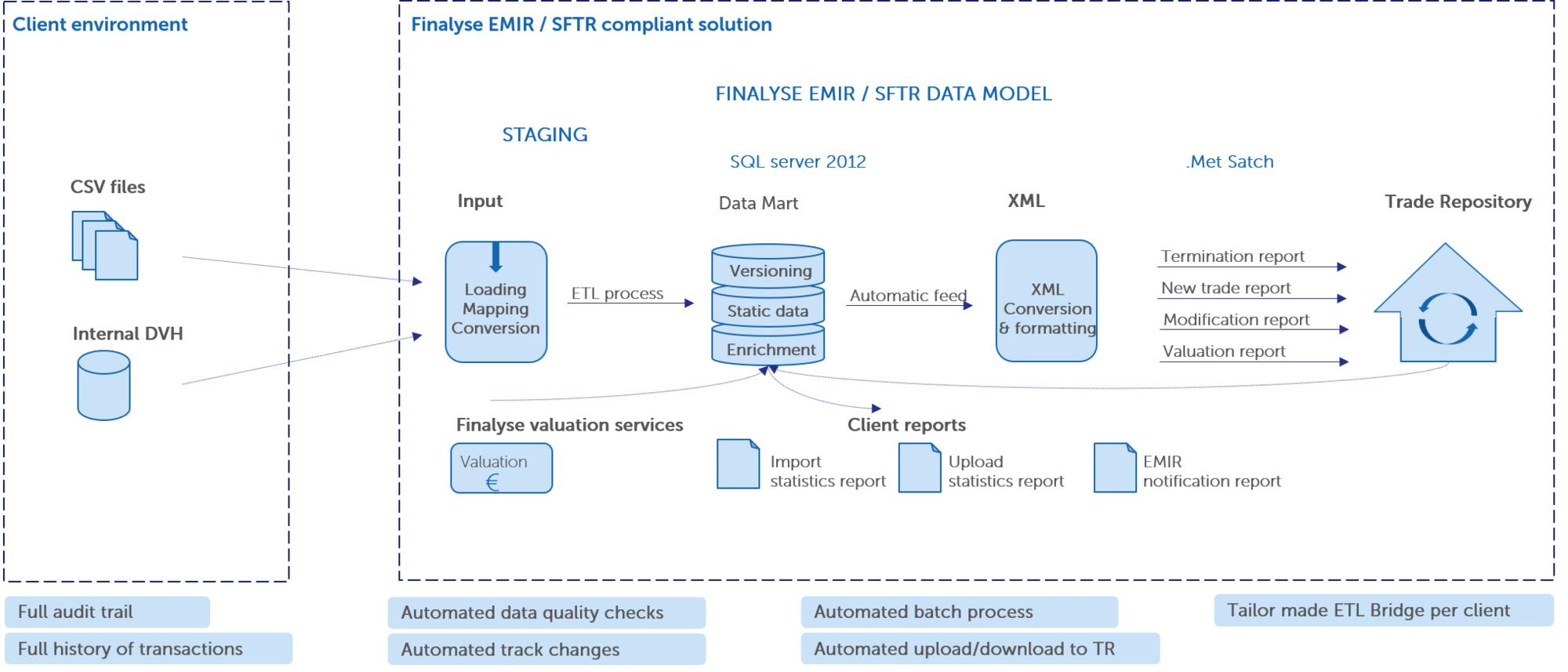

Finalyse EMIR and SFTR Reporting Services Expert Valuation & Managed

With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Reports must be filed using a. Emir mandates reporting of all derivatives to trade repositories (trs). The european securities and markets authority.

EMIR Indicative reporting timeline updated by ESMA EMIRate

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Guidelines for reporting under emir. Trs centrally collect and maintain the records of all. Emir mandates reporting of all derivatives to trade repositories (trs). With the implementation of the second emir refit, reporting to a trade repository has become more extensive.

Finalyse EMIR Refit Reporting

Guidelines for reporting under emir. Emir mandates reporting of all derivatives to trade repositories (trs). In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. With the.

Guidelines for reporting under emir. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Emir mandates reporting of all derivatives to trade repositories (trs). In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Trs centrally collect and maintain the records of all. Reports must be filed using a. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one.

Reports Must Be Filed Using A.

In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Trs centrally collect and maintain the records of all. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one.

Finally, The Validation Rules Document Contains Also A Template For Notifications Of Reporting Errors And Omissions To The Ncas.

Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir mandates reporting of all derivatives to trade repositories (trs). Guidelines for reporting under emir. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying.